-

Compliance

Assistance in the design, implementation and monitoring of Compliance programs within the framework of local and international regulations (FCPA, Corporate Criminal Responsibility Law), including course delivery.

-

ESG & Sustainability

Projects related to ESG (environmental, social and governance) and Sustainability.

-

Forensic

The services offer includes expert advice in litigation resolution and the development of procedures in legal/digital forensics and cybersecurity.

-

Human Capital solutions

Grant Thornton's Human Capital division has a team of professionals determined to accompany individuals and organizations throughout the relationship between the employee and the organization.

-

Organizational restructuring

Advice on operational restructuring to companies in difficulty, their creditors or other interested parties.

-

Services to the Government and the Public Sector

Financial audit projects and special technical and concurrent reviews of programs of national and subnational governments financed by International Credit Organizations. Special projects for government entities, public and mixed companies.

-

Valuation Services

We provide stock, business, asset, and liability valuations in support of negotiations, account structuring, and tax opportunities.

-

Transaction Advisory Services

The service offer includes financial due Diligence, operations services, business and strategic intelligence, ratings, advice on mergers and acquisitions, capital markets and debt advice.

-

Academy - Empowered by Grant Thornton Argentina & Perú

Academy is an e-learning platform that emerged as a joint initiative of Grant Thornton Argentina and Grant Thornton Perú. It is designed so that everyone can acquire new skills in accounting, auditing, taxes, technology and business through access to multiple courses and certifications.

-

External audit

We offer services of external audit of financial statements; assurance reports, agreed procedures and certifications; due-diligence and take-over of companies.

-

Audit methodology and technology

At Grant Thornton we use a single audit methodology across our global network. We apply it through an integrated set of software tools known as the Voyager suite. Meet it now.

-

Professional standards and training

Our IFRS advisors can help you navigate the complexity of the standards so you can spend your time and effort on your business.

-

Prevention of money laundering and financing of terrorism

At Grant Thornton we provide advice to our clients in the development of an Asset Laundering and Terrorist Financing Prevention strategy that allows them to prevent risks in a comprehensive manner.

-

Tax outsourcing

Taxes have a strong impact on your business decisions. At Grant Thornton we will respond quickly and tailor solutions for our clients.

-

Payroll

Put your payroll in good hands while you take your business beyond. Learn about our services.

-

Accounting, administration and finance services

To achieve the highest business benefits, you need an experienced team by your side. Learn about our services.

-

Start-up companies

Learn about our solutions to help build your business.

-

Financial statements audit

We offer services of external audit of financial statements; assurance reports, agreed procedures and certifications; due-diligence and take-over of companies.

-

FIU Independent External Reviewer - AML/CFT

We participate in the implementation of the requirements of the FIU in leading companies and our services ensure an orderly framework, optimizing the investment.

-

Internal audit

An internal audit helps identify gaps, deficiencies, and potential for inherent risk in all facets of the organization.

-

Legal audit

The monitoring of the legal area is usually a complex and difficult task for organizations, which however cannot be neglected.

-

Creation and acquisition of Financial Entities

We have the knowledge and experience in activities related to the acquisition and creation of financial entities, both locally and internationally.

-

Responsible for regulatory compliance

At Grant Thornton we offer the service of acting as "Responsible for Regulatory Compliance and Internal Control" for companies that requested registration as Settlement and Clearing Agent and Trading Agent.

-

IT Internal Audit

IT has been, and will increasingly be, a key factor for success and operational efficiency in all industries. Innovations such as the cloud and virtualization, and new threats around data security, have reinforced the importance and increased the risks associated with the use of technology for our clients.

-

Cybersecurity

As sophisticated digital manipulations become more prevalent, organizations must strengthen their defences and effectively protect themselves from threats and recognize those that are not. Organizations must act quickly to strengthen trust and resilience. A combination of enhanced security capabilities, robust controls, and employee education and awareness is critical.

-

ITGC Controls

Information Technology General Controls (ITGC) are a set of policies that ensure the effective implementation of control systems throughout an organization. ITGC audits help verify that these general controls are implemented and functioning correctly, so that risk is appropriately managed.

-

Global Mobility Services

Sending someone abroad involves liabilities and obligations. We offer interesting solutions to minimize the tax burden for both parties.

-

Direct Tax

We provide clear and practical solutions that meet your specific business needs, in the most tax-efficient way possible.

-

Indirect Tax

Grant Thornton's tax teams take a rigorous approach to help you meeting your tax obligations, whatever challenges you may face along the way.

-

International taxes – Transaction support

We offer our international experience in the field and make available the resources to plan and adequately comply with regulatory frameworks.

-

Services to private clients

Wherever you are in the world, our tax specialists can help you with your interests and investments abroad.

-

Clean energy and technology

Growing demand, development of new ways of energy and need of a sustainable future: we accompany our client in these changes and to be one step ahead.

-

Mining

Our flexible, partner-led teams are dynamic and focused on development. We take time to understand the details of the client’s business and offer unique solutions.

-

Oil and gas

Our Oil & Gas teams have the deep knowledge, wide experience and vision needed to offer our clients practical solutions adapted to their businesses.

-

Banking

Grant Thornton offers meaningful and accurate solutions for operational and transactional issues, litigation and administrative disputes in banking.

-

Private capital

We gather international teams of experts in corporate finance, restructuring and recovery, tax and insurance services to deliver customized solutions from initial investment, through development stages until the end of each project.

-

Fintech

We work to take advantage of all opportunities and manage industry risks, allowing our clients to always be one step beyond their competitors.

-

Asset management

We have specialized teams in more than 140 markets delivering solutions regarding insurance, taxes and advisory to global, international, regional, local asset managers.

-

Insurance

Thanks to our specialized team we offer accurate solutions for operational and transactional matters, litigations and administrative conflicts.

Between September 2020 and April 2022, more than 762,858 Argentines left the country for reasons of study, moving or work. When an Argentine decides to settle abroad and work, he must not only consider the immigration and tax requirements of the country to which he is going, but also those of Argentina.

Likewise, because of the globalization of economic activity, many companies seeking internationalization face the challenge of mobilizing part of their collaborators for a certain period of time to carry out specific tasks abroad.

"International displacement or mobility implies for these companies a series of critical actions before, during and after expatriation -explains Stefanía Marcon, Tax Manager and Global Mobility expert- and for the expatriate, this temporary transfer to a country different from the place where he was hired means a challenge of great social, cultural and economic magnitudes and that is why he must face it with a global vision".

"International displacement or mobility implies for these companies a series of critical actions before, during and after expatriation -explains Stefanía Marcon, Tax Manager and Global Mobility expert- and for the expatriate, this temporary transfer to a country different from the place where he was hired means a challenge of great social, cultural and economic magnitudes and that is why he must face it with a global vision".

Proper planning when leaving the country can prevent certain inconveniences with the treasury and avoid double taxation.

Residents vs. Non-residents

Individuals who have the status of residents in the country will lose it when:

- Acquire the status of permanent residents in a foreign State, according to the provisions governing migration therein; or

- When such acquisition has not previously occurred, they remain continuously abroad for a period of twelve (12) months. Temporary presence in Argentina on a continuous or alternate basis that does not exceed a total of NINETY (90) days during each period of TWELVE (12) months, will not interrupt the continuity of the stay abroad.

Regarding the temporal aspect, the regulations dispose that the loss of resident status will take effect from the first day of the immediate subsequent month in which one of the two previous cases was verified.

“It should be noted that the interpretation of the ‘immediate subsequent’ guideline has been quite discussed, since the wording is not clear,” comments Julia Adano, Lead Tax Partner at Grant Thornton Argentina. "However, based on a conservative interpretation, the effect will occur from the first day of the month that follows the month following the one in which one of the hypotheses was verified."

“It should be noted that the interpretation of the ‘immediate subsequent’ guideline has been quite discussed, since the wording is not clear,” comments Julia Adano, Lead Tax Partner at Grant Thornton Argentina. "However, based on a conservative interpretation, the effect will occur from the first day of the month that follows the month following the one in which one of the hypotheses was verified."

We must highlight that not always when residency is obtained in a foreign State, local tax residency is lost, and there are cases of 'dual residence'.

The situation of double tax residence occurs when individuals who, having obtained permanent residence in a foreign State or having lost their status as residents of Argentina, were considered residents of another country for tax purposes; and continue to actually reside in the national territory or re-enter in order to remain there.

For these purposes, according to the Income Tax Law, it must be considered that Argentine residents will remain residents even if they have obtained residence in another country if they:

- Maintain their permanent home in the Argentine Republic;

- In the event that they maintain permanent homes in the country and in the State that granted them permanent residence, if their centre of vital interests (closer personal and economic relationships) is located in the national territory;

- If the location of the centre of vital interests cannot be determined, if they habitually live in the Argentine Republic, a condition that will be considered met if they remain there for longer than in the foreign State that granted them permanent residence;

- If they remain for the same amount of time in the country and in the foreign State that granted them residence, when they are Argentine nationals.

"One aspect that we must not forget - Adano highlights - is that with respect to the countries with which Argentina has signed an agreement to avoid international double taxation in terms of income tax, the possible conflict of double residence developed previously will be defined with based on the rules of the agreement”.

Communication to the Argentine Tax Authority

The loss of resident status does not operate automatically, but must be accredited - when the cancellation of the Income Tax registration is requested - through:

- The certificate of permanent residence issued by the competent authority of the foreign State (it must have the public translation, signature endorsement at the Public College of Translators and, if applicable, the relevant apostille); or

- Passport, consular certification or other reliable document that proves departure and stay outside the country for a period of 12 months.

The regulations establish that, as long as this formal deregistration process is not carried out, 'all the corresponding tax obligations - formal and material - must be complied with'. “This clarification is not minor because even if a taxpayer complies with the objective requirements established by law to lose his residence, as long as he does not present the aforementioned documentation, he will continue to be subject to all the formal and material obligations that correspond to a resident (even if he is not one),” says Julia Adano.

"In this regard -adds Adano- we understand that the reference to 'material' obligations is excessive since, having lost the status of resident, even if a subject has not formally complied with the deregistration procedures, he would not be obliged to pay taxes on income from a foreign source, and to obtain income from Argentine source, it would be appropriate to apply the current regime for beneficiaries from abroad.”

Regarding the procedure for deregistration and taxes of all taxpayers, the rules establish that when registration is canceled due to loss of residence, the foreign address must be previously reported and at the time of requesting deregistration, the reason must be reported as 'Loss of residence', attaching the aforementioned elements.

Non-residents and taxation in Argentina

From the moment in which an individual ceases to be an Argentine tax resident, if he or she obtains income from an Argentine source, these will be treated as foreign beneficiaries. Likewise, from the moment they lose their tax residence, Argentina will no longer have control over income from foreign sources.

Regarding the Personal Assets Tax, once an individual ceases to be an Argentine tax resident, he or she must only pay tax on the assets that owns in Argentina through the designation as substitute responsible of the person of visible or ideal existence domiciled in the country that has the condominium, possession, use, enjoyment, custody, administration, etc. of its assets subject to tax as of December 31 of each year.

Julia Adano highlights that “as a result of a modification introduced by Law 27,541 on Solidarity and Productive Reactivation, the Personal Property Tax Law was modified establishing that as of the 2019 fiscal period, the 'domicile' criterion is replaced by the 'residence'; additionally establishing that, to lay down the residence of a subject, it is necessary to refer to the criteria of the Income Tax Law.”

Julia Adano highlights that “as a result of a modification introduced by Law 27,541 on Solidarity and Productive Reactivation, the Personal Property Tax Law was modified establishing that as of the 2019 fiscal period, the 'domicile' criterion is replaced by the 'residence'; additionally establishing that, to lay down the residence of a subject, it is necessary to refer to the criteria of the Income Tax Law.”

“In other words, simply ‘moving’ or ‘establishing a domicile abroad’ will not be enough to stop taxing assets located abroad in Personal Assets,” Julia concludes.

Contributions

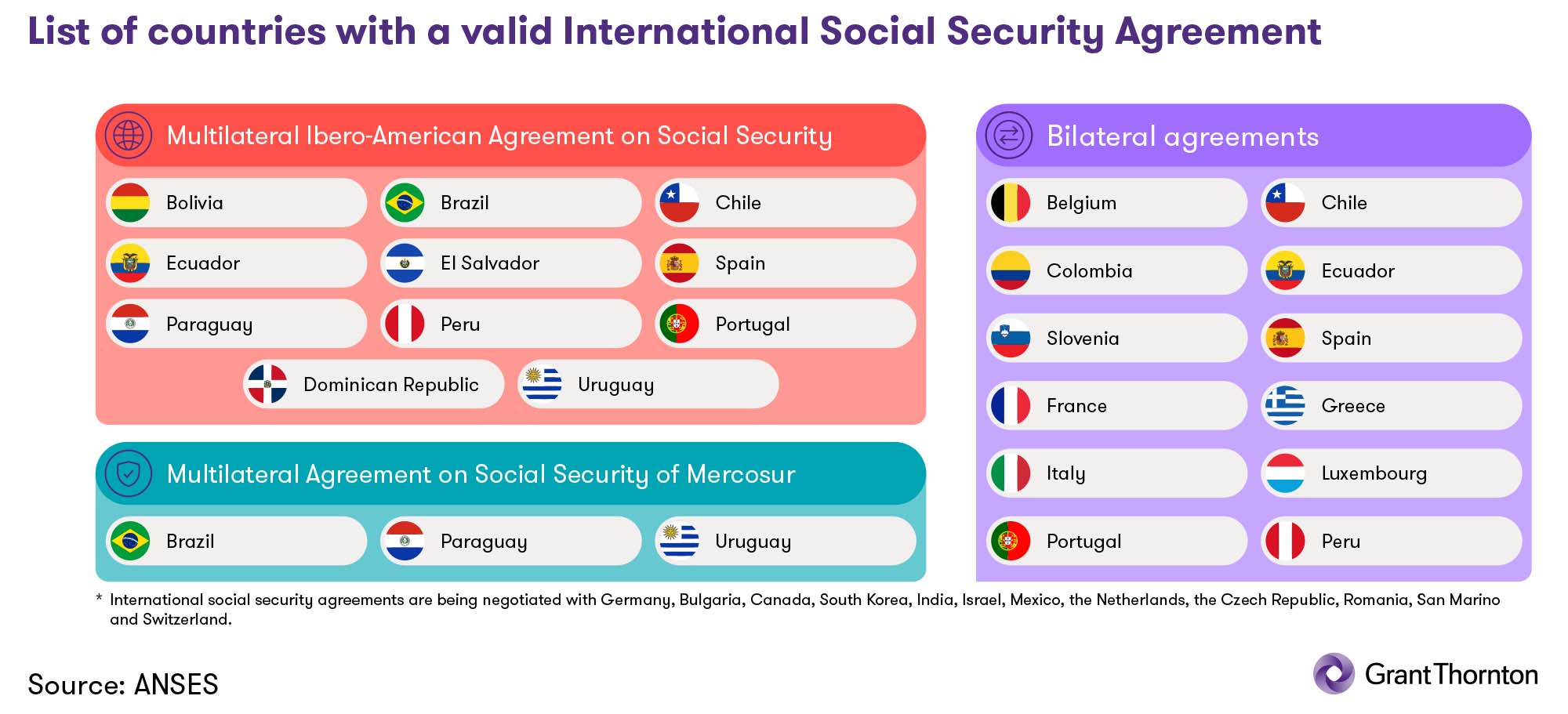

"One of the most common doubts among those who emigrate is what happens to the contributions made to the Social Security Regime", says Marcon. Argentina is part of the Multilateral Agreement on Social Security of Mercosur (2005) and the Multilateral Ibero-American Agreement on Social Security (2016), in addition to having bilateral agreements that provide that the periods contributed in the different party States can be added and that each of the competent institutions take into account, to the extent necessary, the periods of insurance, contributions or employment carried out in others as if they were periods contributed in them.

"One of the most common doubts among those who emigrate is what happens to the contributions made to the Social Security Regime", says Marcon. Argentina is part of the Multilateral Agreement on Social Security of Mercosur (2005) and the Multilateral Ibero-American Agreement on Social Security (2016), in addition to having bilateral agreements that provide that the periods contributed in the different party States can be added and that each of the competent institutions take into account, to the extent necessary, the periods of insurance, contributions or employment carried out in others as if they were periods contributed in them.

Therefore, people who are employees or, in some cases, self-employed in any of the countries with which Argentina has a current International Agreement and make the respective contributions to the Social Security systems could continue accumulating contributions. without losing those made in another country. "Each case and each agreement must be evaluated, also considering the social security legislation of each country", Stefanía clarifies.