The International Federation of Accountants defines fraud as an intentional act by one or more persons among management, those charged with corporate governance, employees or third parties, which involves the use of deception to obtain an unfair or illegal advantage. This can be detected by errors in the financial statements, but it must be differentiated from a mistake in the preparation of the report. The distinguishing factor will be whether the underlying action that produces the error is intentional or not.

There are three major categories of fraud:

• Asset Misappropriation: Cash and inventory and all other assets.

• Corruption: Conflicts of interest, bribery, illegal gratifications, and financial extortion.

• Financial statement fraud: overstatement or understatement of net worth or net income.

According to the ACFE, 47% of fraud cases involve asset misappropriation, which may implicate the embezzlement of income, theft of physical assets or intellectual property, payment for goods and services not received, or the use of assets from an entity for personal use. 12% are corruption and 32% of occurrences involve both misappropriation and corruption. Only 1% of the cases correspond to fraud of financial statements.

However, despite being the least frequent, financial statement fraud involves an average loss of US$593,000; while those resulting from an embezzlement of assets, US$ 100,000.

In Latin America and the Caribbean, the largest number of fraud cases occurs through corruption (59%) and financial statement fraud (17%).

Marcelo Pinto, Partner of Advisory Services at Grant Thornton Argentina, points out that this situation coincides with the recent report by Transparency International on the Corruption Perception Index (CPI) 2022, which states about Latin America that "the lack of bold and firm action to fight corruption and strenghten public institutions is fuelling organized criminal activity, indermining democracy and human rights, and threatening the Sustainable Development Goals (SDGs)".

The fraud triangle

Fraud often occurs when the perpetrator is under pressure, sees the opportunity, and finds a reason for it that sounds reasonable. These three elements are part of the "fraud triangle", a model that explains the factors that lead people to commit employment fraud.

Pressure is usually the reason, and it is often economic. The person perceives an economic need, both personal and professional, and begins to consider carrying out the act.

The opportunity is going to define the way in which the crime will be committed. The person sees a simple way to abuse trust to resolve their conflicts with a low perceived risk of being discovered. The chosen way will be the one that allows him to solve his problem in secret, since he has a status or reputation to uphold.

Lastly, rationalization is a decisive component when it comes to committing fraud, since the person who carries it out must find a way to reconcile. Being people who see themselves as ordinary and honest, they will look for an excuse that is acceptable and decent.

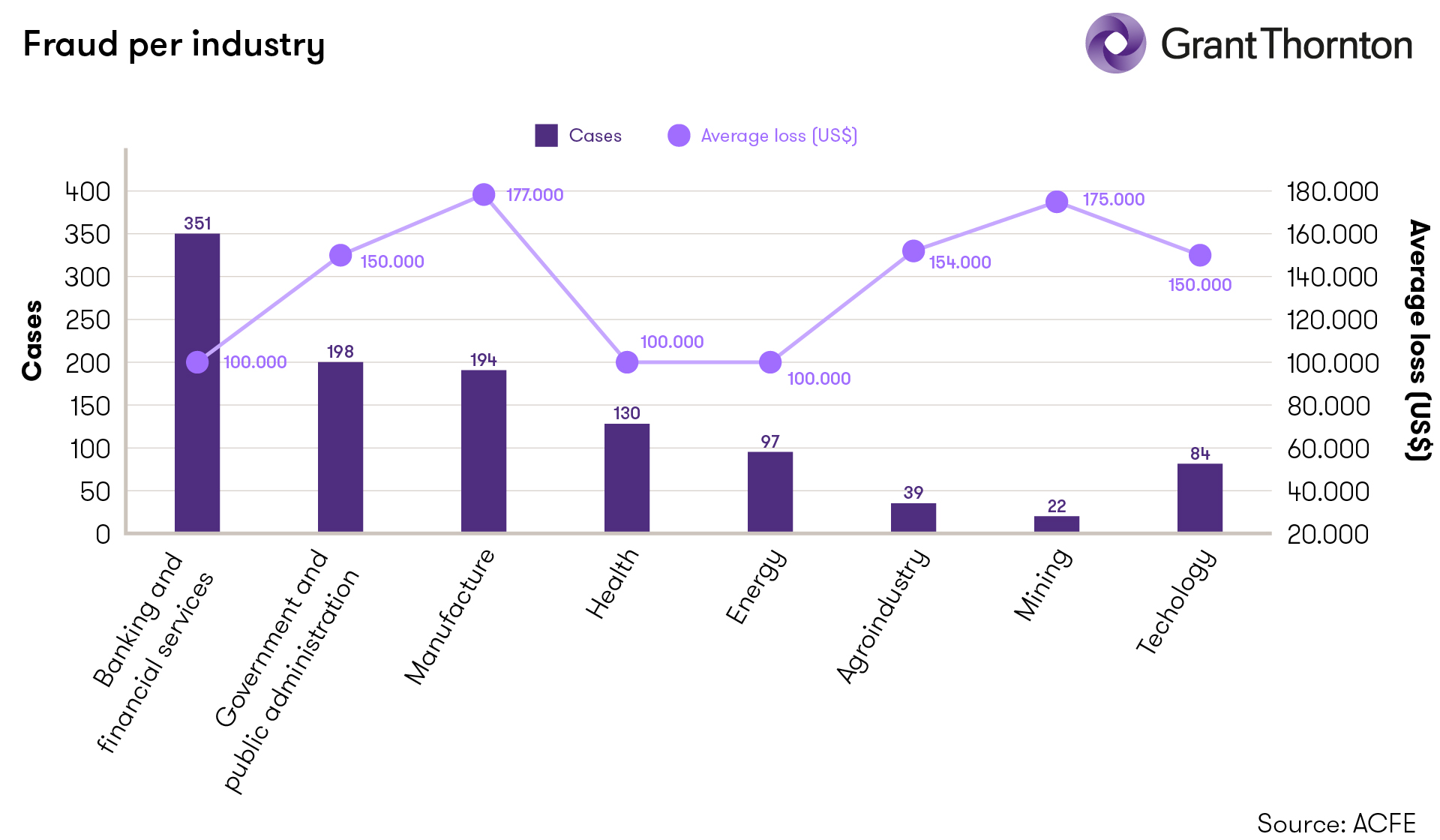

The industries with the most cases of fraud are banking, government, manufacturing, health and energy. Pinto highlights that "these data are consistent with the second factor of the fraud triangle linked to the opportunity to commit the crime and evade its consequences with a low probability of detection (generation of undue exactions through electronic scams)".

For his part, Alejandro Chiappe -partner at Grant Thornton Argentina's Advisory Services- points out that they are mainly “companies or individuals that potentially have some capacity to recover all or part of the loss directly or indirectly through insurance coverage. This dilutes the effect of the crime in the community, making the direct damage invisible.”

Fraud detection

Early detection of fraud is important not only because it significantly reduces the impact that it may have both at the company's financial and reputational level, but it will also discourage future fraudulent actions.

To achieve this, it is necessary to pay attention to the different warning signs or red flags. These can be detected on the person who commits the act and on financial information:

Financial red flags:

- Improper transactions of the nature of the company

- High amounts in employee expense statements

- Overtime payments not related to the activity or declaration of overtime that would not correspond

- Purchases and other transactions with third parties that are related or linked to the employee

- Management decisions are dominated by an individual or small group

- Excessive number of checking accounts

- Frequent bank account changes

- Frequent changes of external auditors

- Company assets sold at market value

- Significant drawdown in a stable and thriving market

- Continuous loan renewal

- Excessive number of year-end transactions

- High employee turnover rate

- Unexpected overdrafts or drops in cash balances

- Refusal by an employee or division to use serially numbered documents

- Missing documents

Staff red flags:

- Leads a lifestyle that is not commensurate with salary

- Has financial difficulties

- Has a very close relationship with a customer or supplier

- Has behavioural problems

- Reluctant to share tasks or information

- Is easily irritated, mistrusts everything and always acts defensive

- Is going through health problems or family problems

- Is victim of bullying or workplace harassment

- Complains about work and the company

- Refuses to go on holidays

- Does not interact with the rest od the employees

There are also human resources red flags, these are related to the company-employee link. Many cases of fraud happen when the person is not satisfied with the working conditions or environment. The discontent may be due to a salary increase or position being rejected, salary or benefits cut, fear of job loss, or the layoff notice has already been served and is about to be fired.

It should be noted that the detection of these warning signs is as important as the actions that are carried out after identification. In this sense, Pinto points out that red flags must be part of a system within organizations that allows not only to identify them (since it does not always imply the existence of fraud), but also to classify and analyse them so that they become trigger resources for a comprehensive scheme control, such as the use of key fraud indicators (KFI). But "for this system to be effective, it is essential to foster a culture of fighting fraud throughout the organization," he says.

"Complementarily, the anonymous hotlines serve as one more element of investigation and containment of these negative behaviours in the organization", Chiappe adds.

The auditor's rol

In accordance with the International Standard on Auditing (ISA) 240, issued by the International Auditing and Assurance Standards Board (IAASB), the auditor must identify and assess the risks of material misstatement in the financial statements, obtaining sufficient evidence to design and implement the necessary procedures and respond appropriately.

When the auditor conducts an audit, if he finds an error in the financial statements, he must determine if it corresponds to an inadvertent accident or fraud. To do this, it can be guided by the "expertise of the perpetrator, frequency and extent of manipulation, degree of collusion involved, the relative size of the individual amounts manipulated, and the seniority of those involved", in addition to its experience to detect those aspects that are more prone to material misstatement due to fraud.

In the case of detecting errors compatible with fraud, the auditor will not make legal considerations, but will limit himself to notifying those who have the main responsibility for the prevention and detection of fraud.

Since this task corresponds to the managers and corporate governance of a company, if the auditor has identified or suspects that they may be involved, he must determine if there is a responsibility to report it to a party outside the entity. And while the professional duty of confidentiality may preclude this reporting, the auditor's legal responsibilities may outweigh it.

Grant Thornton experts agree that being alert to the appearance of signs of fraud is not only a professional responsibility in the exercise of functions as auditors or consultants, but also a matter of attitude towards the development of the activities in which participate as employers, employees, clients, suppliers, consumers, etc. Respect for ethical values and the behaviour and attitude of leaders is critical, both internally within the company or institution and in its integration into the social environment in which it operates.

If you would like to receive advice on fraud prevention or learn more about it, contact us.