Global insights

The challenges of navigating the global economy have been highlighted by a record number of mid-market business leaders expecting an increase in profitability (up one point to 60%) coinciding with a drop in optimism (down two points to 65%), according to Grant Thornton’s latest International Business Report (IBR).

A closer examination of the data offers some explanation of this apparent contradiction.

The record number of businesses expecting an increase in profitability is most likely due to inflation being brought under control. This is highlighted by a five-point drop (down to 50%) in the number of businesses expecting to increase their selling prices over the next 12 months.

Every business constraint tracked in the IBR has also eased, indicating less pressure on margins. For example, those citing labour costs as a constraint is down two points to 51%, those citing energy costs as a constraint is down two points to 52%, and those citing a shortage of finance is down four points to 40%.

Elsewhere, concerns over a shortage of orders has dropped five points to 43%; concerns over red tape and regulation is down four points to 47%; and concerns over availability of skilled labour is down three points to 50%.

While these numbers have dropped, most have dropped marginally and still remain well above average since the IBR research began.

However, there is little doubt that the relentless pressure on margins may finally be easing, as seen by a four point drop in the number of businesses expecting to provide real salary increases over the next year (down to just 19%). This may also explain the marginal increase (up one point to 50%) in the number of businesses expecting to increase the number of people they employ. But there is no escaping the gloomy geopolitical landscape. Despite a marginal drop of one point, economic uncertainty remains the most frequently cited constraint, by 57% of mid-market business leaders.

That uncertainty has spilled over into a less optimistic outlook for international trade. Business leaders expecting to increase exports has dropped four points to 43%. This is driven by a three point drop (down to 40%) in the number of leaders expecting to increase the number of countries they sell to and a two point drop (down to 42%) in those expecting to increase revenue from non-domestic markets. Perhaps the record number of countries voting in elections and the potential regulatory and geopolitical upheaval that may cause might be tempering the international ambitions of business?

And while profit expectations are up, the one point rise is matched by a one point drop in those expecting to see an increase in revenues over the next 12 months – down to 59% of respondents.

This expectation may be flowing through to marginal falls in business investment expectations. However, investment in technology remains top of the list with no change in proportion of leaders (61%) expecting to increase investment in this area. Elsewhere there is a one point drop in investment in staff skills (down to 56%), a two point drop in investment in research and development (down to 52%), no change in investment in plant and machinery at 46%, and a two point drop (down to 36%) in investment in new buildings.

Peter Bodin, CEO of Grant Thornton International commented: “Our latest IBR highlights the complexity and difficult choices that business leaders face. Does improving profitability mean an opportunity to focus on growing market share through changes in pricing strategy? Do persistent concerns over economic uncertainty and continuing geopolitical challenges signal a need to prepare for more volatility? And does an improving inflation outlook and falling interest rates mean better financing options? As always, it depends. It depends which market you are in. It depends what condition your business is in. It depends on the competitive landscape in your industry.

Peter Bodin, CEO of Grant Thornton International commented: “Our latest IBR highlights the complexity and difficult choices that business leaders face. Does improving profitability mean an opportunity to focus on growing market share through changes in pricing strategy? Do persistent concerns over economic uncertainty and continuing geopolitical challenges signal a need to prepare for more volatility? And does an improving inflation outlook and falling interest rates mean better financing options? As always, it depends. It depends which market you are in. It depends what condition your business is in. It depends on the competitive landscape in your industry.

“Despite lower levels of optimism, it is not all doom and gloom – but neither is it getting any easier to choose a clear path. With the global economy in a lower growth trajectory, the decisions made by business leaders will have a far bigger impact on whether companies are successful or not. As our data highlights – making the right choices is not getting any easier, and to navigate these challenges our clients will need our support.”

Argentine insights

While globally the level of optimism has fallen, in Argentina the situation is opposite: in the second half of 2023 optimism index has doubled, going from 24% to 48%.

This growth in optimism is the result of improvements in the indexes of expectation of expansion to non-domestic markets, business growth and investment in assets. On the other hand, the expectations of limitations perceived by managers of mid-market companies in Argentina showed significant decreases compared to the first semester, with the exception of the indices of economic uncertainty and nominal salary increases.

With a 21 percentage point increase in the expectation of higher profitability (to 49%), the variation from 20% to 40% in the expectation of increase in investment in personnel skills in the next 12 months, and an increase of 14 percentage points in expectations of increased employment (43%) and entry into foreign markets (25%), the leaders of the Argentine mid-market foresee improvements in business in the next 12 months.

In this context, the 75 managers and senior executives from Argentina surveyed by the International Business Report were consulted on three current issues in our country.

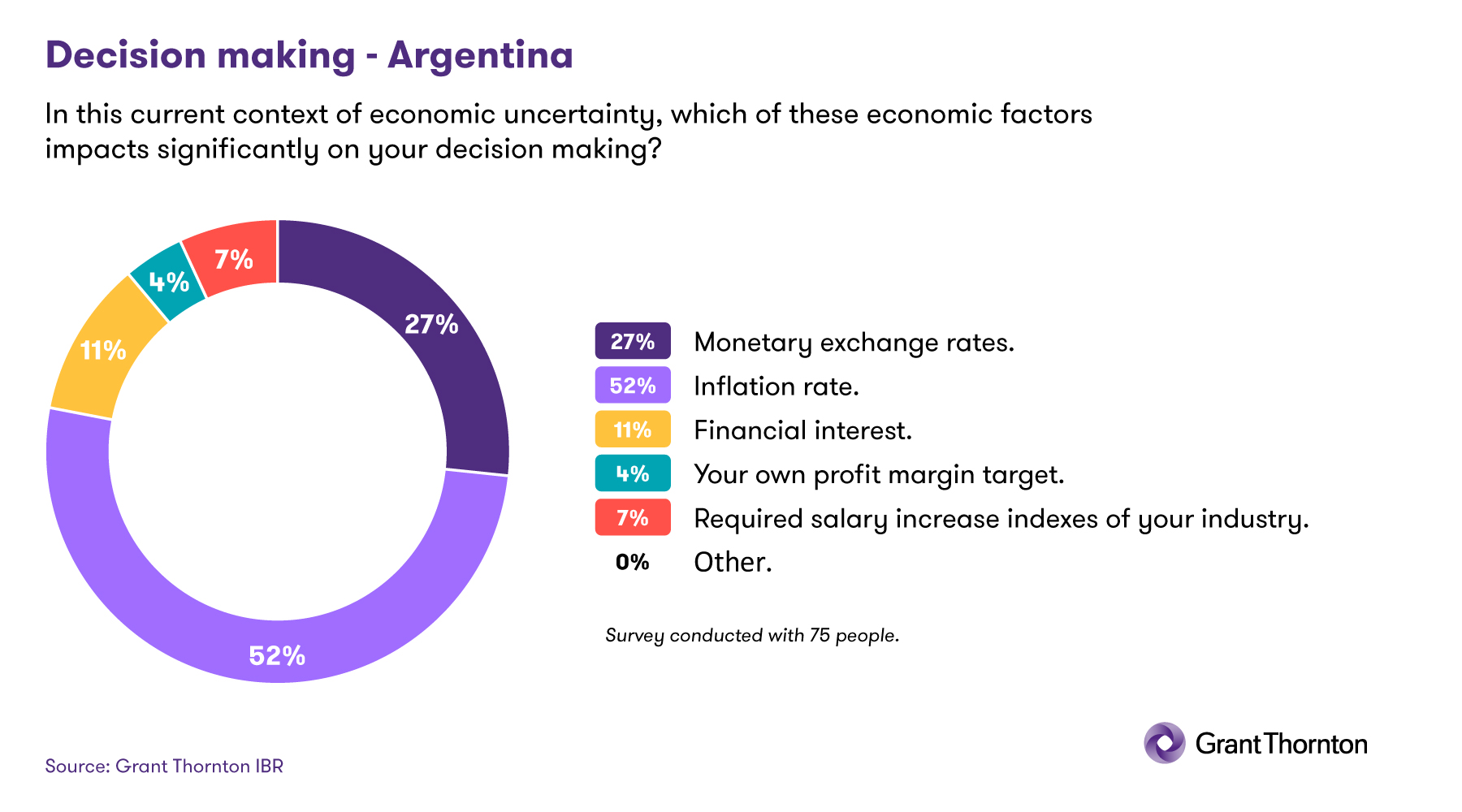

The first of these topics was which factor has the greatest impact when making decisions.

Over half of the Argentine professionals surveyed (52%) see the inflation rate as the most relevant factor when making decisions. 27% find that monetary exchange rates is the factor that most significantly impacts decisions, 11% cliam it is financial interest, 7% the salary increase rates required in their industry and 4% see the greatest impact in their own target profit margin.

Over half of the Argentine professionals surveyed (52%) see the inflation rate as the most relevant factor when making decisions. 27% find that monetary exchange rates is the factor that most significantly impacts decisions, 11% cliam it is financial interest, 7% the salary increase rates required in their industry and 4% see the greatest impact in their own target profit margin.

When asked about talent attraction and retention strategies, 44% surveyed by the IBR claim to offer training and professional development, 41% offer salaries above market- average, 36% offer monetary rewards related to employee performance, 23% grant additional leaves/time off, 21% have employee benefit programs and 17% have improved physical and mental health programs as one of their strategies.

When asked about talent attraction and retention strategies, 44% surveyed by the IBR claim to offer training and professional development, 41% offer salaries above market- average, 36% offer monetary rewards related to employee performance, 23% grant additional leaves/time off, 21% have employee benefit programs and 17% have improved physical and mental health programs as one of their strategies.

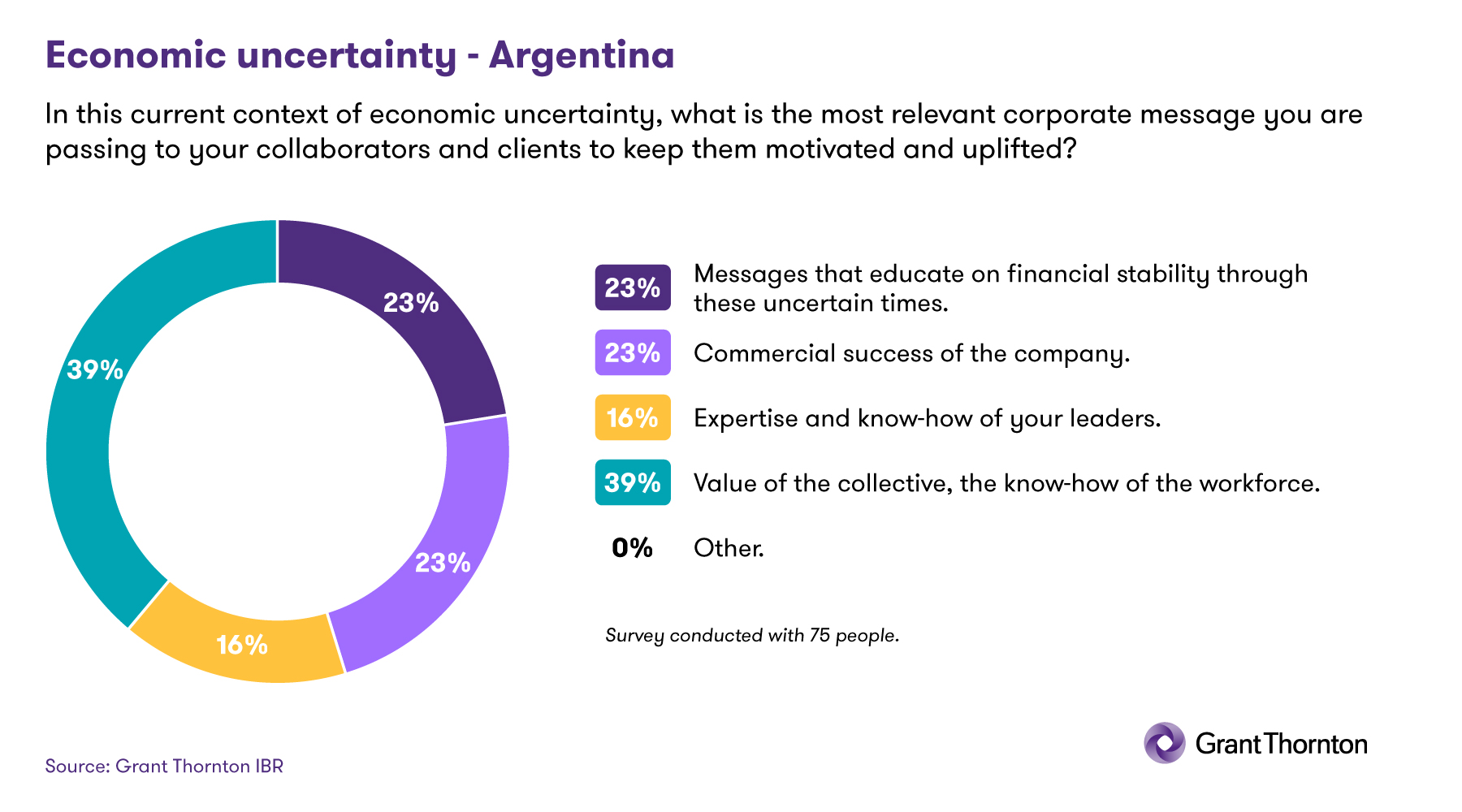

Finally, in the current context of economic uncertainty, 39% of those surveyed consider the collective value of the teams and the know-how of the collaborators as the most relevant corporate message, 23% highlight financial stability of the firm in times of uncertainty, 16% communicate the experience and know-how of their leaders, and 23% emphasize the commercial success of the company. The communication of each organization is strategized based on these messages.

Finally, in the current context of economic uncertainty, 39% of those surveyed consider the collective value of the teams and the know-how of the collaborators as the most relevant corporate message, 23% highlight financial stability of the firm in times of uncertainty, 16% communicate the experience and know-how of their leaders, and 23% emphasize the commercial success of the company. The communication of each organization is strategized based on these messages.

Fernando Fucci, Managing Partner and IBC Director of Grant Thornton Argentina comments: “In this context of declining business optimism at a global and regional level, the positive data in our country leads us to analyze two issues. On the one hand, participation in foreign markets is posed as an important challenge. However, it is a challenge that many Argentine industries can face thanks to competitiveness in production costs and the capacity of their talent supported by the intention to invest in technology, research and development, talent retention programs, among others.

Fernando Fucci, Managing Partner and IBC Director of Grant Thornton Argentina comments: “In this context of declining business optimism at a global and regional level, the positive data in our country leads us to analyze two issues. On the one hand, participation in foreign markets is posed as an important challenge. However, it is a challenge that many Argentine industries can face thanks to competitiveness in production costs and the capacity of their talent supported by the intention to invest in technology, research and development, talent retention programs, among others.

On the other hand, in relation to the domestic market, the first month of the year is marked by uncertainty due to regulatory changes and the search for stability in a wide variety of sectors. Without a doubt, the resilience that characterizes the Argentine productive sector is a characteristic that strengthens middle market companies and will allow them to navigate the changes that arise. At Grant Thornton Argentina we have multidisciplinary teams, more than 40 years of experience advising companies and institutions and methodologies and work tools that allow us to remain competitive in this dynamic context. Our network with presence in more than 140 countries allows us to generate commercial opportunities based on global trends for the benefit of our clients in Argentina".