According to the latest National Agricultural Census (2021), in Argentina, 85% of the territory is destined for agricultural and forestry use. This puts agribusiness in first place as the country's main economic and productive engine.

The severe drought that has been sustained since November 2022 and began to decrease as of March 2023 severely affected agricultural and livestock activities. Sowings were delayed, plague appeared and affected production and pastures, and there was a decrease in fodder which. Added to the problems for the supply of animal water, the drought produced not only the loss of cattle, but also a decrease in pregnancy rates, loss of body condition and low performance.

In January 2023, the national official bulletin (Boletín Oficial de la República Argentina) declared a state of emergency and/or agricultural disaster in 13 provinces. At the same time, 4 provinces took local measures to mitigate the crisis until they were approved by the National Government.

February of 2023 was the month most affected by the drought. 173,626,316 hectares of crops and 24,333,868 heads of cattle were compromised. After this month, there was a period of climate neutrality with moderate rainfall that allowed the recovery of soil moisture in more than 45 million hectares and the increase in water reserves in much of the country. However, the water deficit pattern continued to predominate.

For this reason, the National Government published a new Decree declaring a state of emergency and/or disaster until December 31, 2023. According to this legislation, taxpayers whose main activity is agriculture or livestock and the property in which the main activity is carried out is in a declared, approved, and current emergency and/or agricultural disaster zone due to drought, they will automatically obtain the benefits provided by Law No. 26,509 and its amendments.

Prior to this relaxation of the procedure for accession to the benefits of the aforementioned Law, the producers affected by the emergency had to make the request with their tax code on the AFIP website. "In this instance, in addition to confirming the status of beneficiary and that the affected exploitation constitutes their main activity; they had to attach the emergency certificate issued by the competent authority of the respective province and the documentation that accredits the quality of owner or, as the case may be, of the tenant or lessee of the affected property”, explains Julia Adano, Tax Partner and Agribusiness spokesperson at Grant Thornton Argentina.

Prior to this relaxation of the procedure for accession to the benefits of the aforementioned Law, the producers affected by the emergency had to make the request with their tax code on the AFIP website. "In this instance, in addition to confirming the status of beneficiary and that the affected exploitation constitutes their main activity; they had to attach the emergency certificate issued by the competent authority of the respective province and the documentation that accredits the quality of owner or, as the case may be, of the tenant or lessee of the affected property”, explains Julia Adano, Tax Partner and Agribusiness spokesperson at Grant Thornton Argentina.

"Based on the new regulation from the Decree 193/23 and the 5,350 General Resolution (AFIP), taxpayers must only process the agricultural emergency certificate before the competent provincial authority, who will be the one that informs AFIP so that it can assign the corresponding categorization, which can then be consulted”, Adano clarifies.

“Although the benefits contemplated by the regime are measures that try to partially alleviate the damage caused by the severe drought that hit the agricultural sector in different regions of our country, these modifications imply, for those who decide to benefit from it, a simplification of the procedure of adhesion”, she emphasizes.

What to expect in the future

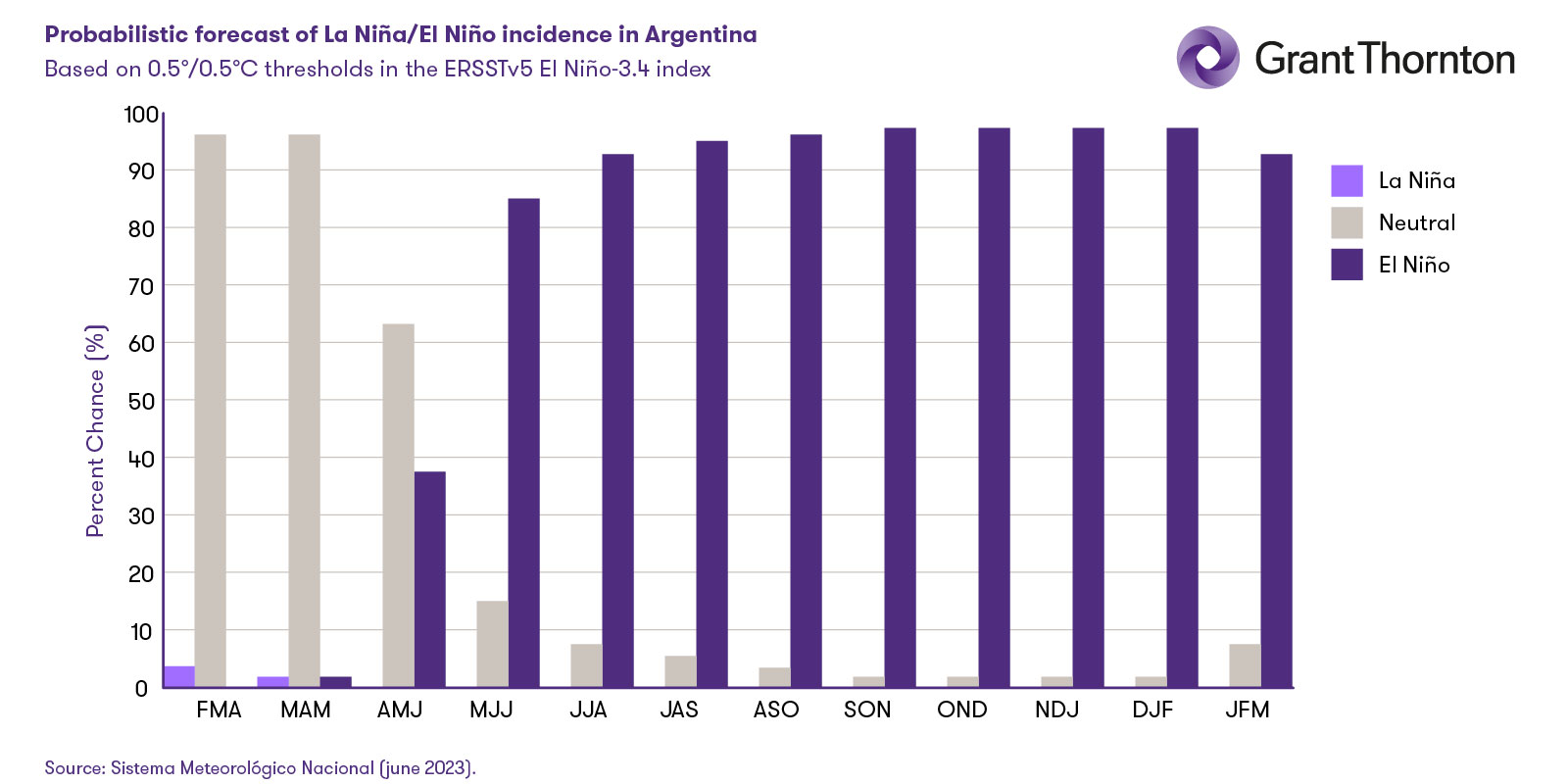

According to the dynamic and statistical models of the National Meteorological Service, on average, in the June-July-August 2023 (JJA) quarter, there is a 92% probability of development of an "El Niño" climatic phase, characterized by rainfall above normal standards and is expected to last all winter.

However, the Agricultural Risk Office (ORA) of the Ministry of Agriculture, Livestock and Fisheries, points out that in the western NOA and northern Cuyo regions no rain is forecast for the May-June-July quarter (MJJ), as it is dry season in the region.

Far from being a complete relief for much of the country, the rain after long periods of drought can seriously damage the livestock sector and cause the loss of cattle due to nitrate poisoning.

This phenomenon occurs due to the accumulation and concentration of nitrates in the plants, which have not been transformed into vegetable protein due to water scarcity that prevents normal crop growth. This process is enhanced if nitrogenous fertilizers -such as urea- were previously applied and did not leach out, or when the soil has high nitrogen concentrations due to previous crops.

In these cases, both agronomic and financial planning is important, since in many cases prevention would imply the purchase of fodder or the use of cereals for other purposes.

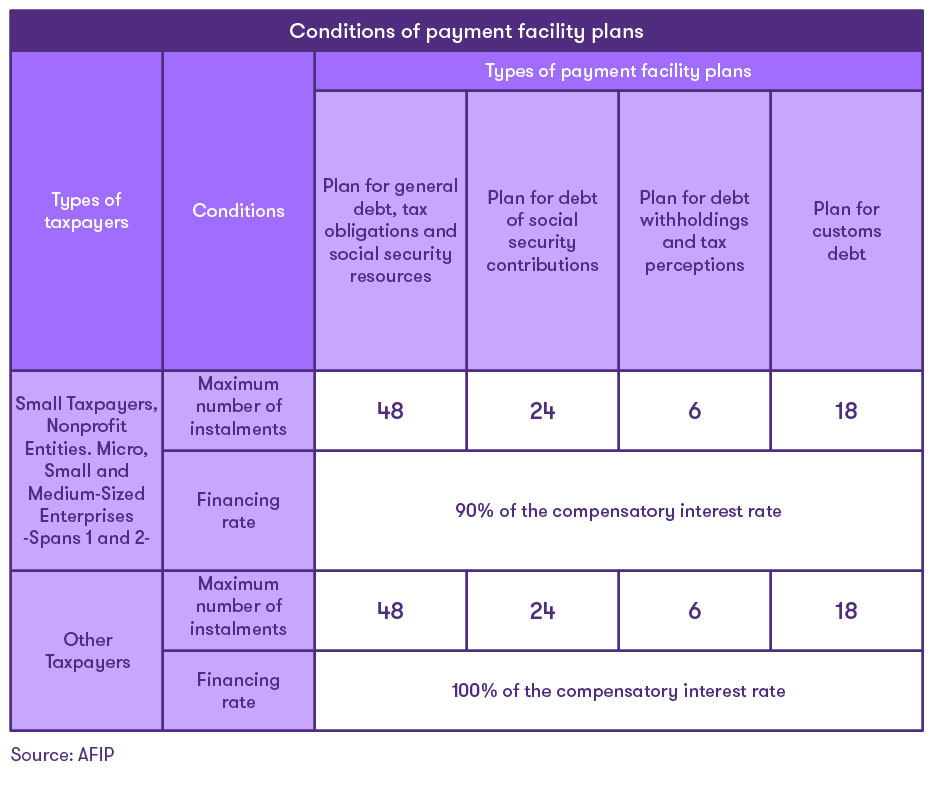

In this sense, Julia Adano comments that General Resolution 5,350 also contemplates a plan of payment facilities for debts derived from tax obligations and social security resources due as of March 31, 2023, including interest and fines, additional charges for import or export taxes and liquidations of these and their interests. "Taking into account the particular situation of each taxpayer, the activity carried out and the context, it may be convenient to consider the use of the plan that, although does not imply the reduction of interest or the release of sanctions, allows the financing of debt in fees and can provide relief", she concludes.

Argentina in the international scenario

After the export records in the annual accumulated volume in the ports of Quequén and Bahía Blanca in 2022, with 7,553,681 and 31,409,347 tons respectively of mobilized grains, the National Ministry of Agriculture calculates that the national exportable balance of grains and by-products will be reduced by 42.8% in relation to 2022 and 1,285 fewer cargo ships are projected to enter the different ports of Argentina to transport exports.

“This drop in exports significantly affects foreign exchange earnings. This means fewer reserves for the Central Bank and lower tax collection, negatively impacting our macroeconomy”, comments Arnaldo Hasenclever, Director of the Grant Thornton Argentina International Business Center. “This year, what has not yet impacted our energy industry is the President Néstor Kirchner gas pipeline, which will transport gas from Vaca Muerta. This work would allow importing less energy and generate lower cost. In any case, this savings would not fully compensate the loss from agricultural exports”, he adds.

“This drop in exports significantly affects foreign exchange earnings. This means fewer reserves for the Central Bank and lower tax collection, negatively impacting our macroeconomy”, comments Arnaldo Hasenclever, Director of the Grant Thornton Argentina International Business Center. “This year, what has not yet impacted our energy industry is the President Néstor Kirchner gas pipeline, which will transport gas from Vaca Muerta. This work would allow importing less energy and generate lower cost. In any case, this savings would not fully compensate the loss from agricultural exports”, he adds.

During March 2023, cereal exports decreased by 56% compared to the same month of the previous year. This is because the lack of surface moisture conditioned the progress of sowing in the 2022/2023 season, mainly compromising the sowing of second-rate soybeans and early corn. “Soybean was also affected by the drop in international prices. There were good harvests in the United States and in Brazil, which had a record harvest. However, this year the ton does not exceed USD$600, so the effect is double: drought and a drop in the price,” explains Hasenclever.

“The transport industry is also affected since the logistics of cereals to ports has decreased. In fact, there are also fewer grain trucks on the road. In the same way, regional economies are harmed, affecting towns all over the country. No matter how much does the “soybean dollar” conversion to Argentine Peso is, or which differential value has been put for other cereals and concepts, these do not compensate for the losses caused by the crisis due to the drought”, concludes Arnaldo.