According to IBR global research results, 65% of local companies expect their revenues to increase in the next year, which marks a growth of 4 percentage points as opposed to what was identified in the first half of 2022.

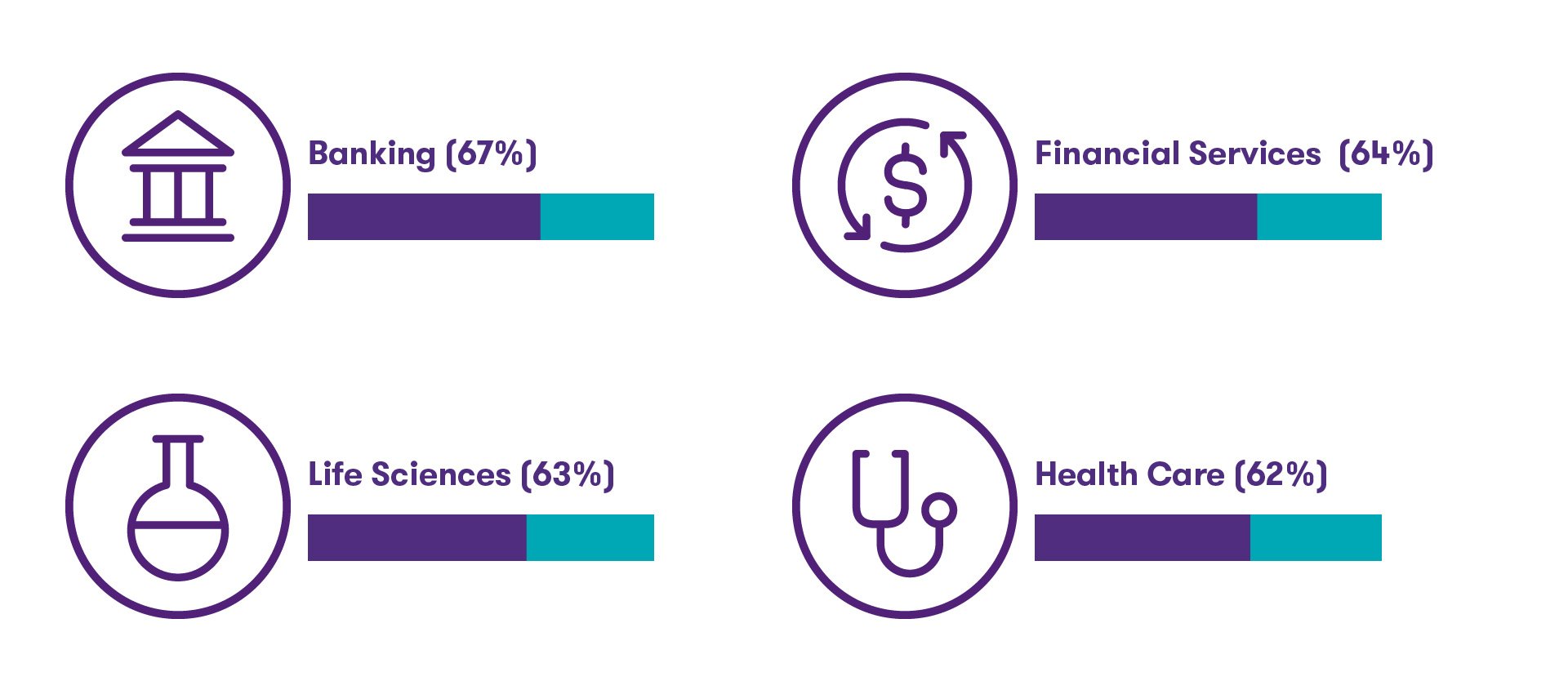

While globally some industries such as banking (67%), life sciences (63%), financial services (64%) and health care (62%), project higher earnings growth.

The business optimism factor in Argentina remains constant at a net 25% over the past year.

“Many companies are convinced that they will increase their sales in the next year and this is always good. The challenge for them will be to maintain profit margins, strongly threatened by cost increases. For those multinational companies accustomed to measuring their indicators in hard currency, the uncertainty regarding the evolution of the nominal exchange rate against inflation is added”, explains Fernando Fucci, Managing Partner of Grant Thornton Argentina.

“Many companies are convinced that they will increase their sales in the next year and this is always good. The challenge for them will be to maintain profit margins, strongly threatened by cost increases. For those multinational companies accustomed to measuring their indicators in hard currency, the uncertainty regarding the evolution of the nominal exchange rate against inflation is added”, explains Fernando Fucci, Managing Partner of Grant Thornton Argentina.

For its part, an increase in employment is also expected at the local level. 43% of the companies expect to open jobs and add collaborators in the next 12 months, which implies a growth of 9 percentage points in relation to the first half of last year.

Sustainability, a priority for Argentine businessmen

“There is clearly a growing demand from civil society regarding respect for the environment and the penalization of business practices that do not consider them,” says Alejandro Chiappe, Advisory partner at Grant Thornton Argentina. And he adds that "consequently the most exposed companies have taken note of the reputational risks involved."

“There is clearly a growing demand from civil society regarding respect for the environment and the penalization of business practices that do not consider them,” says Alejandro Chiappe, Advisory partner at Grant Thornton Argentina. And he adds that "consequently the most exposed companies have taken note of the reputational risks involved."

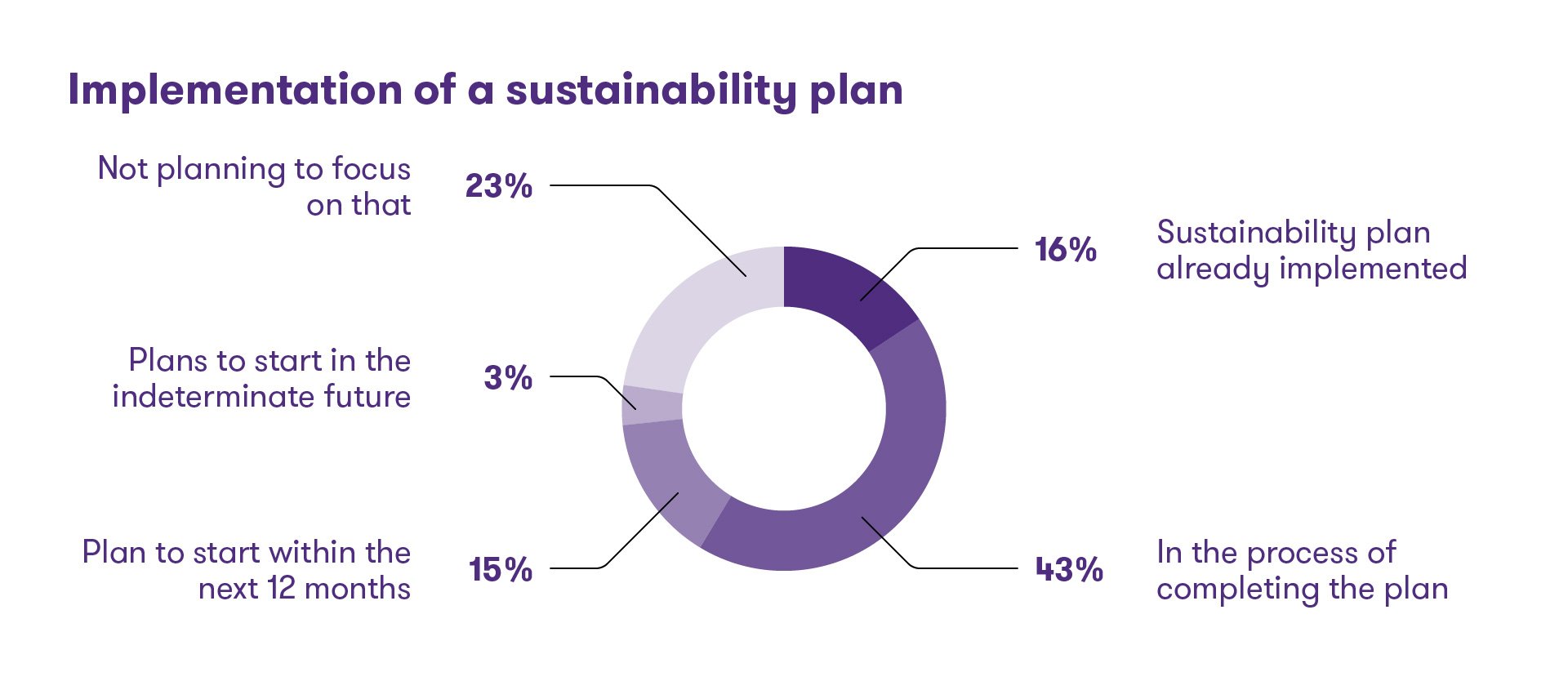

This was reflected when responding to the implementation of a sustainability plan in companies, since 43% reported being in the process of completing the plan and 16% have already implemented it. For their part, 15% will work on it throughout the year and 3% will do so in the future, although without a specific date. Only 23% of companies do not plan to focus on that.

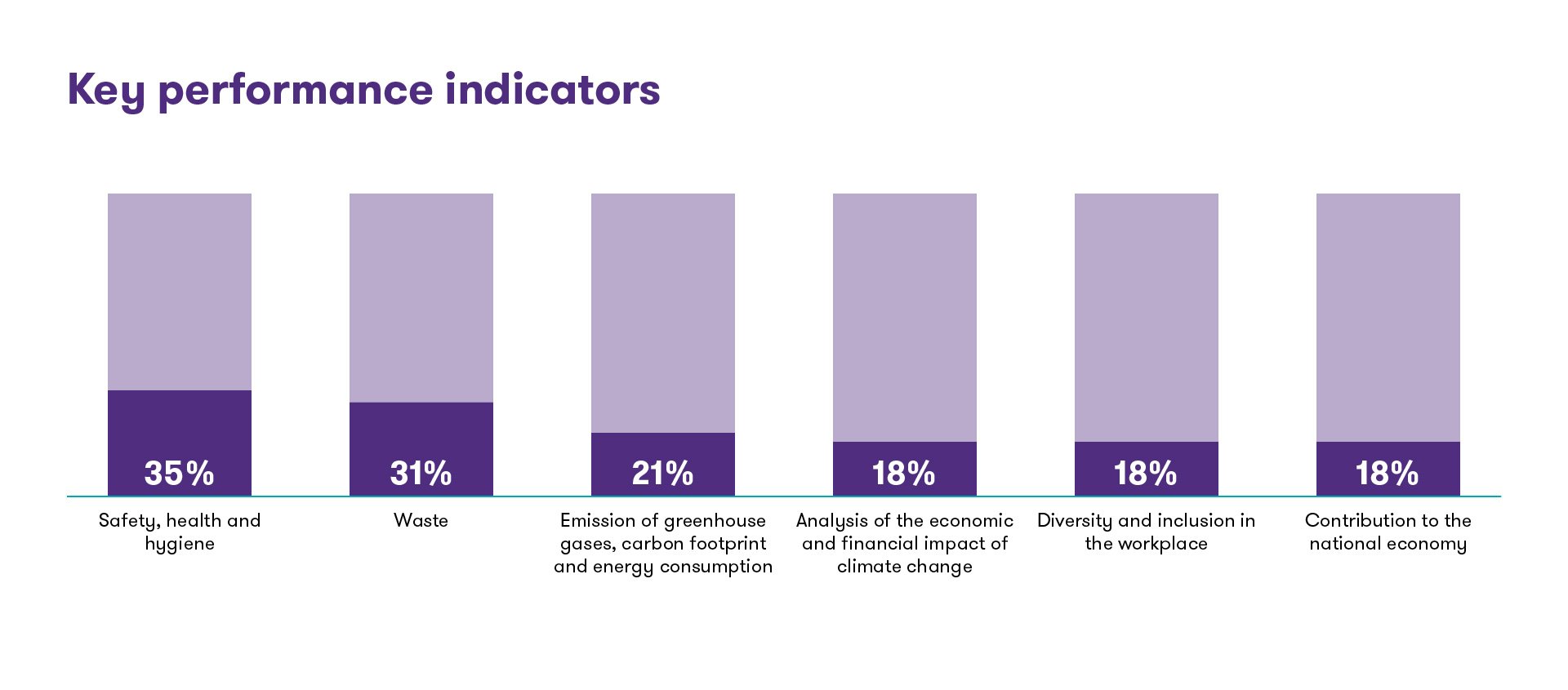

The definition and measurement of key baseline indicators is important in order to later be able to clearly assess the impact of improvement measures and implementation of best sustainable practices.

To that effect, 35% of the companies measure safety, health and hygiene, 31% waste and 21% the emission of greenhouse gases, carbon footprint and energy consumption. For their part, 18% analyze the economic and financial impact of climate change, diversity and inclusion in the workplace and contribution to the national economy.

Balance between work and personal life

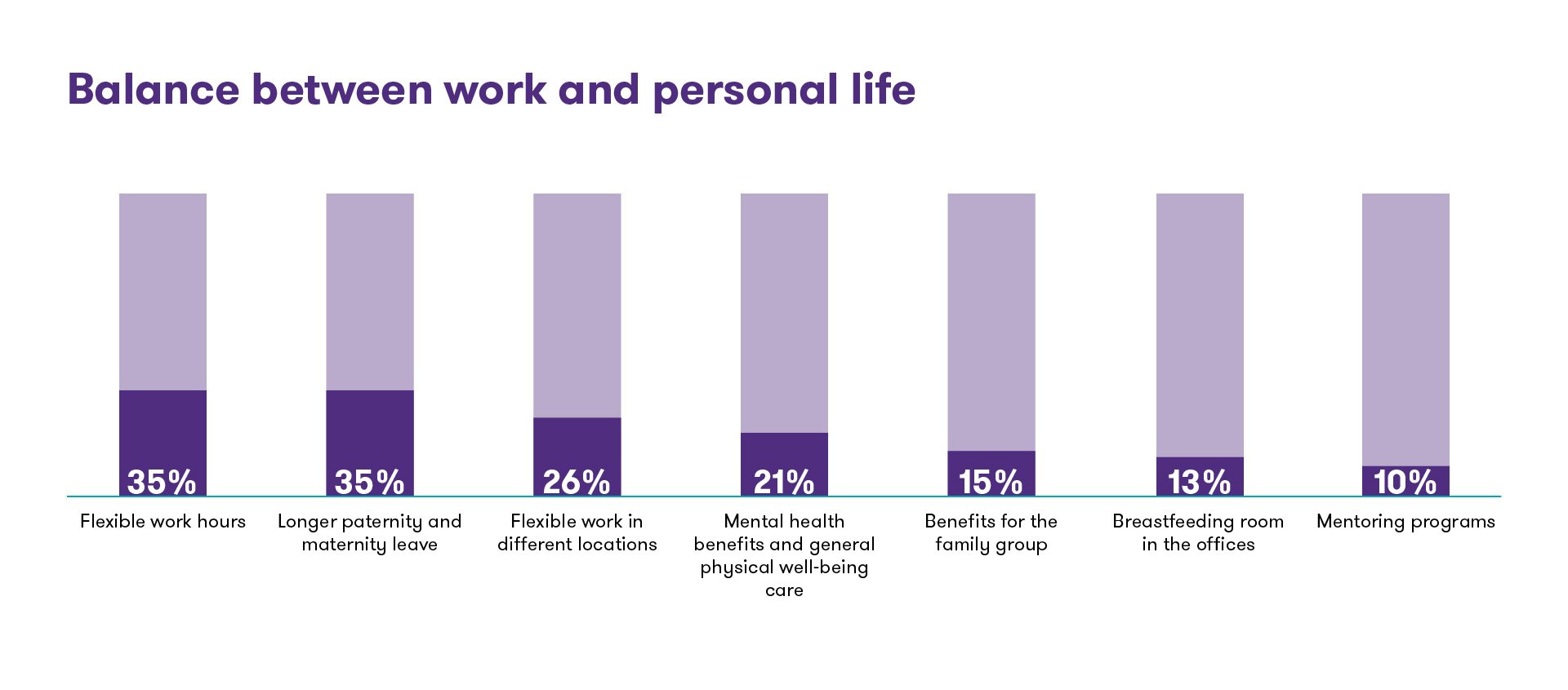

Another of the issues addressed in the study are the policies that companies implement so that their collaborators can balance their work life with their personal life, an aspect that is increasingly valued by employees when deciding whether to stay or enter a job or company.

In this vein, 35% allow time flexibility; in the same percentage, more extended paternity and maternity leaves are offered than what is stipulated by law. 26% contemplate the possibility of working flexibly in different locations, while 21% offer mental health benefits and general physical well-being care . Below are listed benefits for the family group (15%), breastfeeding room in the offices (13%) and mentoring programs (10%).

Inflation, costs and expenses linked to the business

At the economic level and linked to the actions that entrepreneurs plan to take to manage cost increases and inflation, 45% highlighted that they are carrying out processes to improve internal efficiency, costs and reduce spending. For their part, 40% indicated that they are working on plans to mitigate the risks associated with inflation and 20% will focus their efforts on working on differentiating the products and services they provide.

Only 18% of companies are taking action on external costs (renegotiating or redefining contracts with suppliers, limiting prices on some expenses, etc.) and in pursuit of reducing debt or interest levels.

"In a scenario that is expected to be complicated, most companies are inclined to work on improving efficiency by reducing costs and expenses, while a smaller proportion aims to differentiate their products, which would allow them to have better prices and income. What is certain is that all of them will need to optimize the management of the financial variables that are decisive in the final result in companies that operate in inflationary economies”, comments Fucci.

Global point of view

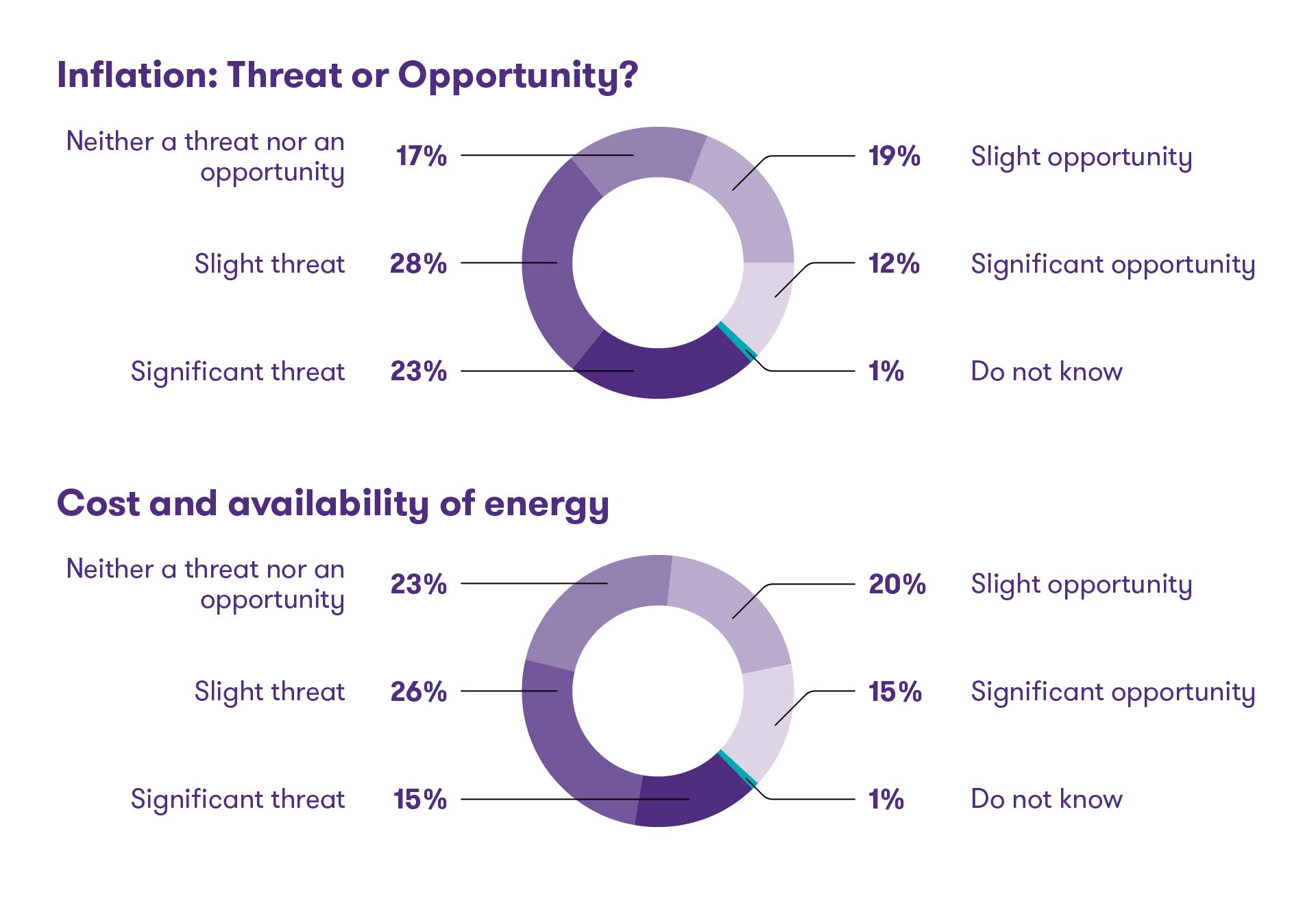

From the global perspective of the IBR, regarding inflation, 28% of companies worldwide indicate that inflation poses a slight threat to their business, while 23% see it as a significant threat and 12% as a significant opportunity. Regarding the cost and availability of energy, 26% see it as a slight threat, while 20% see it as a slight opportunity.

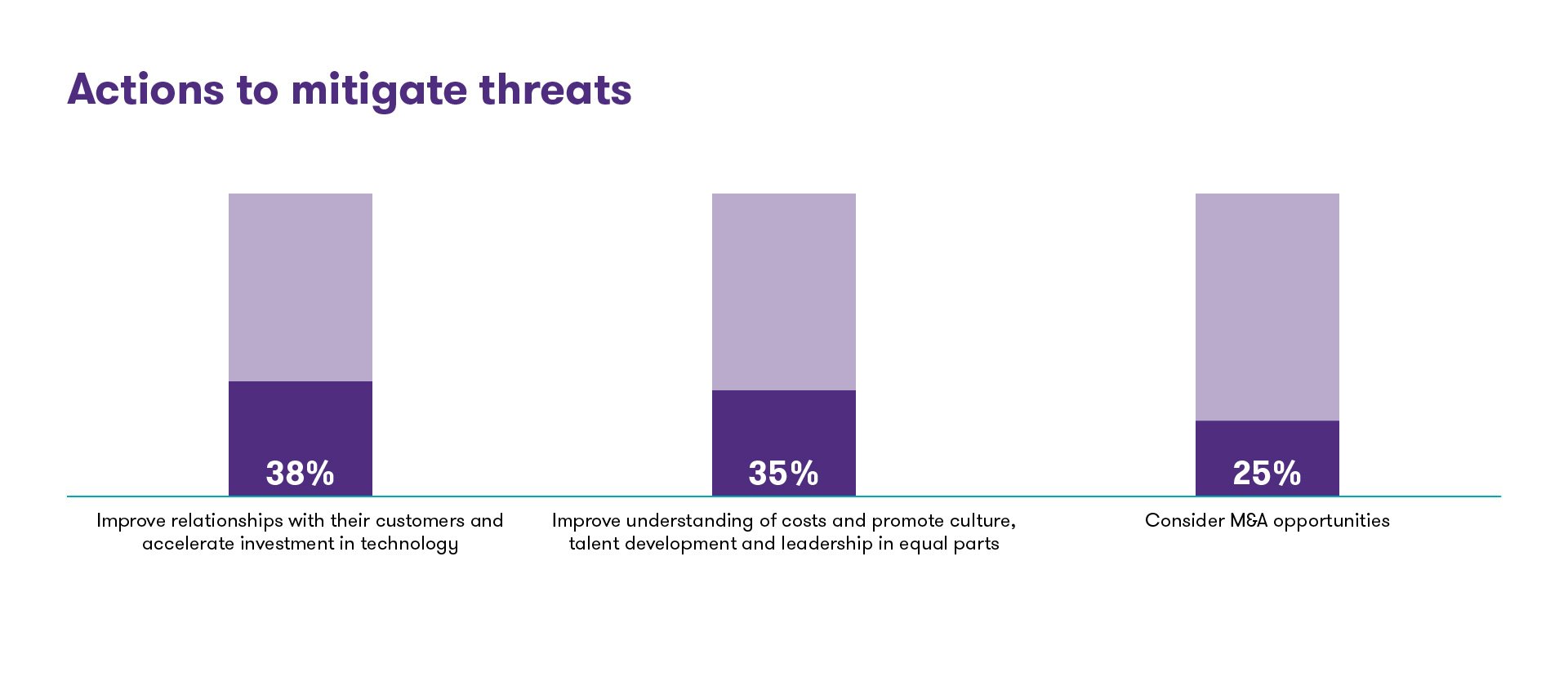

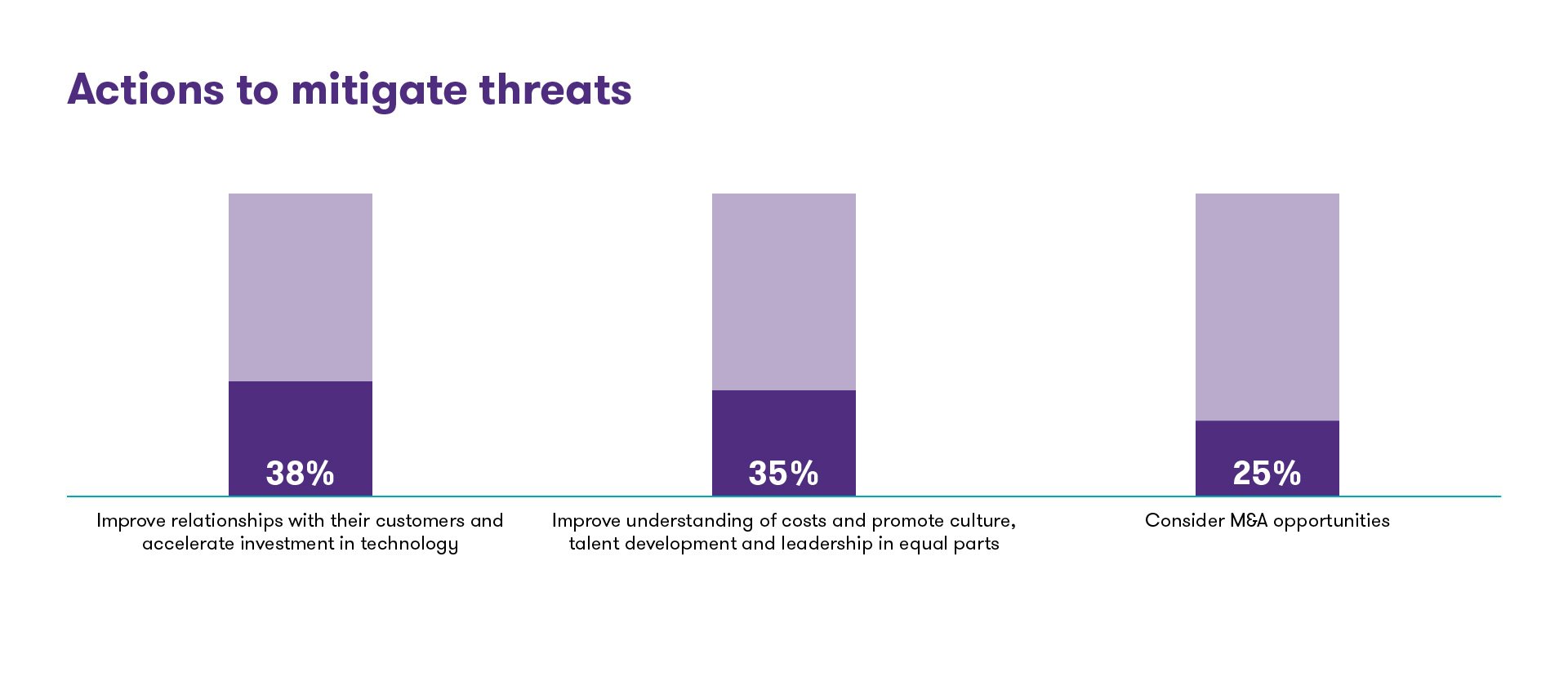

To mitigate the different threats linked to their businesses, companies are taking different actions. 38% are improving relationships with their customers and accelerating investment in technology, 35% understanding their costs and promoting culture, talent development and leadership in equal parts. Meanwhile, 25% are considering merger and acquisition (M&A) opportunities.

About the IBR

Grant Thornton's International Business Report (IBR) is the world's leading survey of midsize businesses. Launched in 1992 in nine European countries, our research now interviews around 10,000 senior executives in more than 140 economies each year, providing insights into health and issues affecting both private and publicly traded companies.

Read more about the findings in the International Business Report Second Semester 2022.

Download the Oxford School of Economics Analysis of the IBR.